Introduction: How Does Financing a Car Work?

Buying a car is a massive economic selection, and for maximum human beings, paying the whole rate upfront isn’t realistic. That’s in which vehicle financing comes in. If you’ve ever wondered How Does Financing a Car Work, this text explains the entire technique in easy phrases from selecting a lender to creating your very last mortgage payment.

Car financing allows you to borrow cash from a financial institution, NBFC, or lender to buy a vehicle and pay it off in monthly installments (EMIs) over a hard and fast period. Understanding how to finance vehicle paintings allows you to keep away from high hobbies, hidden fees, and negative mortgage terms.

Table of Contents

What Is Car Financing?

Car financing is a loan association wherein a lender pays the automobile supplier on your behalf, and you pay off the lender through the years with hobby.

Key Components of Car Financing

- Loan amount

- Interest charge

- Loan tenure

- Monthly EMI

- Down price

Knowing these components is critical to understanding How Does Financing a Car Work in real lifestyles.

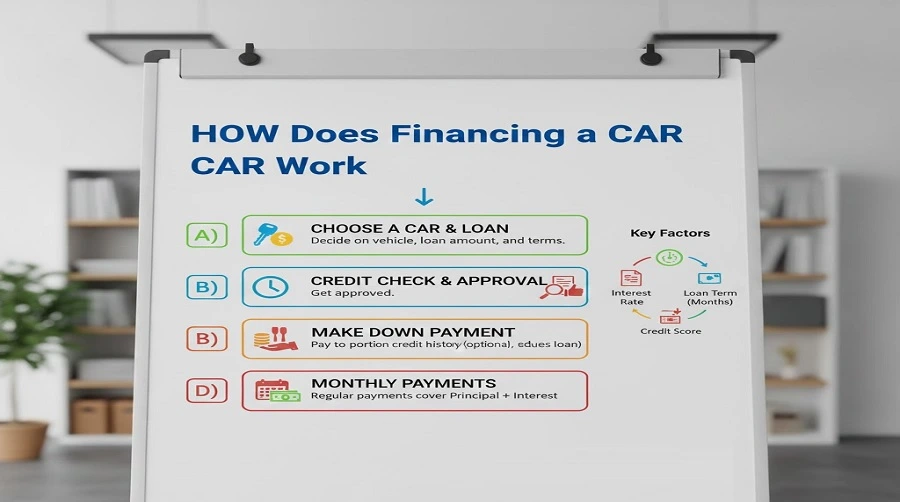

How Does Financing a Car Work? Step-by using-Step Process

Step 1 – Choose the Car

The procedure of How Does Financing a Car Work starts off evolved while you select:

- Car version

- Variant

- On-street fee

Your vehicle’s charge at once influences your loan quantity and EMI.

Step 2 – Decide the Down Payment

A down charge is the quantity you pay upfront.

| Down Payment % | Loan Amount Impact |

|---|---|

| 10% | Higher EMI |

| 20% | Balanced EMI |

| 30%+ | Lower EMI & interest |

👉 Higher down charge = lower interest burden.

Step 3 – Select a Lender

You can finance a vehicle thru:

- Banks

- NBFCs

- Car dealerships

- Online lending platforms

Comparing creditors is essential while studying how to finance automobile paintings efficiently.

Step 4 – Loan Application & Approval

You publish:

- ID proof

- Income proof

- Address proof

- Bank statements

Loan approval depends on:

- Credit rating

- Income

- Employment type

Step 5 – Loan Disbursement

Once approved:

- Lender pays dealer immediately

- Car is registered to your call

- Loan lien is introduced to RC

This completes the center procedure of how financing an automobile works.

Types of Car Loans Explained

Understanding loan types clarifies how financing a vehicle works higher.

| Loan Type | Best For | Key Feature |

|---|---|---|

| New Car Loan | New vehicles | Lower interest |

| Used Car Loan | Second-hand cars | Higher interest |

| Zero Down Payment Loan | Low savings | Higher EMI |

| Balloon Loan | Short-term affordability | Large final payment |

Interest Rates in Car Financing

Fixed vs Floating Interest Rates

| Interest Type | Pros | Cons |

|---|---|---|

| Fixed Rate | EMI stays same | Slightly higher rate |

| Floating Rate | Can reduce over time | EMI fluctuation |

Interest charges are a main element in how to finance car paintings financially.

Role of Credit Score in Car Financing

Your credit score rating notably influences:

- Loan approval

- Interest price

- Loan amount

| Credit Score Range | Loan Impact |

|---|---|

| 750+ | Best rates |

| 700–749 | Good approval |

| 650–699 | Higher interest |

| Below 650 | Difficult approval |

A good credit rating makes financing a vehicle painting at a greater low cost.

Car Loan EMI Explained

What Is EMI?

EMI (Equated Monthly Installment) is the fixed month to month amount you pay.

EMI consists of:

- Principal reimbursement

- Interest factor

EMI Calculation Factors

| Factor | Impact on EMI |

|---|---|

| Loan amount | Higher amount = higher EMI |

| Interest rate | Higher rate = higher EMI |

| Loan tenure | Longer tenure = lower EMI |

Loan Tenure: Short vs Long Term

| Tenure | EMI | Total Interest |

|---|---|---|

| 3 years | High | Low |

| 5 years | Medium | Medium |

| 7 years | Low | High |

Choosing the right tenure is important when knowing how financing a car works accurately.

Additional Costs in Car Financing

Many buyers overlook hidden fees.

| Cost Type | Details |

|---|---|

| Processing fee | 0.5%–2% of loan |

| Late payment fee | If EMI delayed |

| Foreclosure charges | Early loan closure |

| Documentation charges | One-time fee |

Being aware of those allows you to master how does financing a car work absolutely.

Car Ownership During Financing

Even although you drive the car:

- Lender holds ownership rights

- Car can’t be sold without NOC

- RC indicates hypothecation

Full ownership transfers best after loan closure.

What Happens If You Miss an EMI?

Missing EMIs can:

- Increase penalties

- Hurt credit score

- Lead to repossession

Timely payments are important to hold. How does financing a car work to your preference?

Prepayment and Foreclosure

Can You Close the Loan Early?

Yes, maximum creditors allow:

- Part prepayment

- Full foreclosure

| Option | Benefit |

|---|---|

| Prepayment | Lower interest |

| Foreclosure | Full ownership faster |

Always take a look at fees before intending.

Car Financing vs Paying Cash

| Factor | Financing | Cash Purchase |

|---|---|---|

| Immediate cost | Low | High |

| Interest | Yes | No |

| Credit score impact | Builds credit | No impact |

| Ownership | After loan | Immediate |

Understanding this evaluation clarifies how does financing a car work vs shopping outright.

Common Mistakes to Avoid

❌ Choosing loan based totally on EMI only

❌ Ignoring overall interest

❌ Not evaluating lenders

❌ Opting for extremely lengthy tenure

❌ Skipping mortgage settlement studying

Avoiding these mistakes improves your financing experience.

Tips to Get the Best Car Financing Deal

✔ Improve credit score score

✔ Pay better down fee

✔ Compare interest rates

✔ Choose shorter tenure

✔ Negotiate processing prices

These tips optimize how does financing a car work for you.

Final Thoughts

Understanding how does financing a car work empowers you to make knowledgeable decisions, keep money, and avoid stress. With the proper mortgage shape, car financing will become a clever economic device in place of a burden.

Summary

Understanding how financing vehicle paintings allows customers to make smarter economic decisions. This guide explains automobile loan kinds, interest fees, down payments, EMIs, credit score ratings, approval steps, prices, and commonplace mistakes so that you can finance a vehicle with a bit of luck and avoid overpaying.

Main questions to ask on this – how does financing a car work

1. How does financing a vehicle paintings in simple phrases?

Ans. A lender can pay for the automobile, and also you repay the quantity in month to month EMIs with hobby over a set duration.

2. Is financing a vehicle an awesome idea?

Ans. Yes, if managed nicely, financing allows you to buy a vehicle without monetary stress while retaining financial savings.

3. What credit score is needed for automobile financing?

Ans. A score of 700 or above will increase approval probabilities and lowers hobby costs.

4. Can I promote an automobile below finance?

Ans. No, you must first close the mortgage and take away hypothecation from the RC.

5. Is early loan reimbursement beneficial?

Ans. Yes, early reimbursement reduces hobby burden, but take a look at foreclosures charges first.